How to Control Your Cash Flow: Strategies to Ensure Financial Stability

Effective cash flow management is essential to any company’s financial stability and success. The ability to maximize cash flow, track the flow of cash and outflows, and make educated decisions by analyzing cash flow is essential. Here are the most critical strategies for How to Control Your Cash Flow, which can help to ensure financial stability:

1. Lease, don’t buy

Letting assets rather than buying them all at once is the best way to save cash. It is not just a way to reduce the initial cost but also provides more flexibility in responding to the changing needs of business.

2. Offer Discounts for Early Payments

Inviting customers to pay their invoices on time by offering discounts on early payment speeds up cash flow. This method promotes a healthy cash flow and improves customer relations.

3. Conduct Credit Checks for Customers

To ensure no interruptions in cash flow, Conduct thorough credit checks before providing the terms of credit to clients. It reduces the chance of defaults or late payments to ensure a consistent cash flow.

4. Create a Cooperative to purchase goods. Cooperative

Working with other businesses to form a purchasing cooperative increases purchasing power. This approach to buying together can result in cost savings and improved cash flow management.

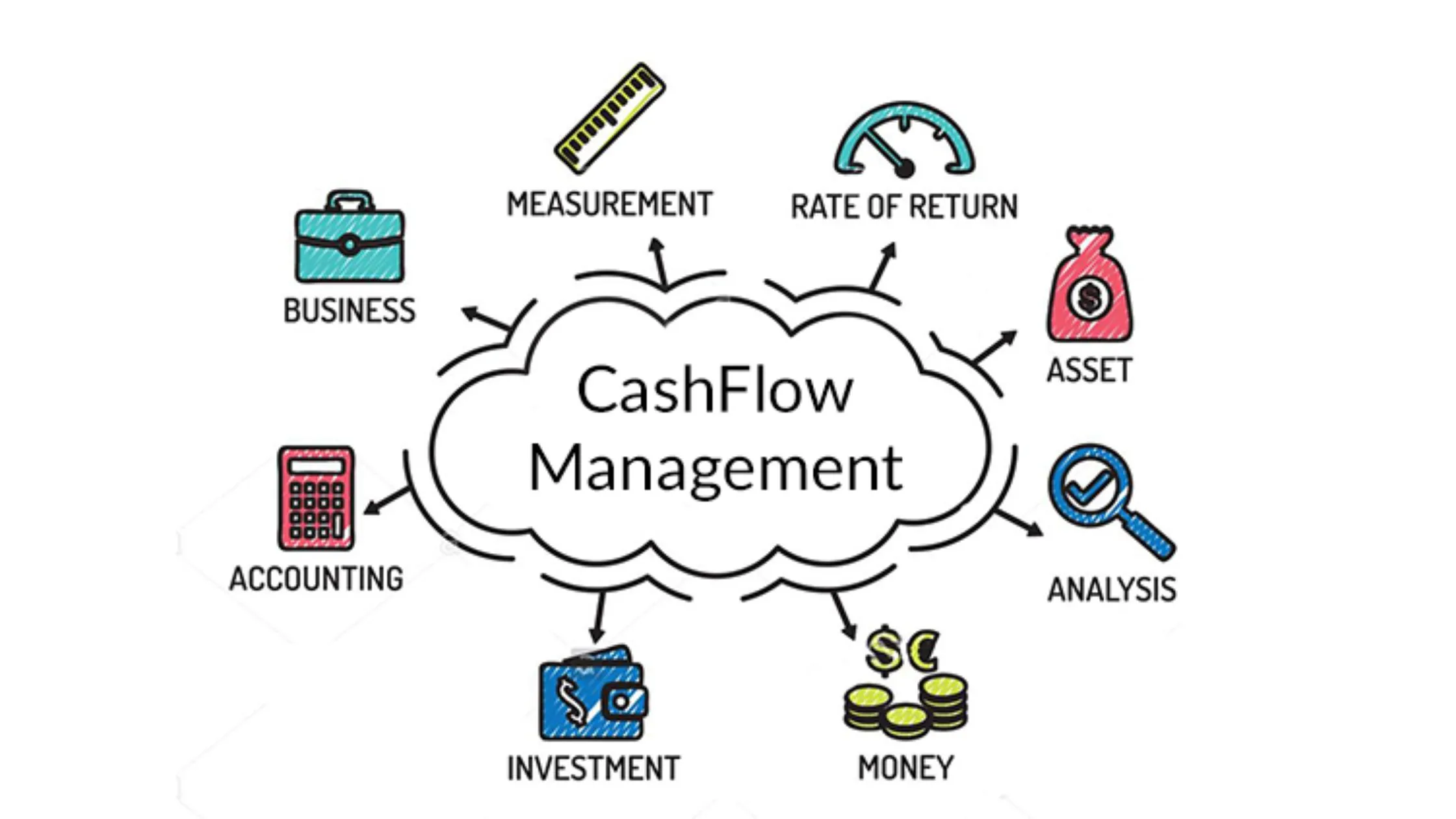

5. Statement of Cash Flow Management

Optimizing your funds available requires a thorough method of controlling your statement of cash flows. Review and analyze your cash flow statements regularly to find patterns and opportunities for better decisions.

6. Cash Analysis of Flow

Conducting a thorough cash flow analysis is essential to understanding the ins and outs of your company’s financials. This analysis allows for an informed decision-making process and helps identify areas of improvement in managing cash flow.

7. The Freelancer’s Handbook to How to Control Your Cash Flow

For freelancers, mastering the art of cash flow management is crucial. Monitoring and analyzing cash flow into and out is vital to ensure financial stability in a volatile freelance environment.

8. Strategies and Principles to Improve Stability and Growth in the Business Stability

Controlling cash flow effectively in a commercial setting depends on adhering to the fundamentals and practical strategies. It helps ensure stability and long-term success.

9. Strategy for managing cash flow in small and Medium-sized Businesses

Small and medium-sized enterprise leaders can establish the most essential practices for efficiently managing cash flow. It includes making strategic decisions, as well as improving operational processes.

10. Diversify Revenue Streams

Explore ways that can diversify the revenue stream and reduce dependence on one source. This may involve increasing product offerings, establishing into new market segments, and even introducing other services. Diversification improves financial stability, by reducing risks that are associated with market volatility.

11. Implement a Cash Flow Forecasting

The adoption of robust cash flow forecasting methods allows businesses to anticipate the financial future. By forecasting cash flow inflows and outflows, businesses are able to be proactive in planning for periods of low cash flow and efficiently allocate resources and take strategic decisions that will improve financial stability.

12. Streamline Accounts Receivable

Effective management of accounts receivables is essential. Establish systems for tracking outstanding invoices, define precise payment terms and then follow-up on late payments. This will speed up cash collection, and guarantees the same and consistent cash flow.

13. Embrace Technology

Utilize the latest technology to ensure efficient cash flow administration. Automated invoices, digital payment systems as well as accounting software can simplify processes, decrease errors and offer real-time insight of financial transactions.

14. Keep an Contingency Fund

A contingency fund can serve as a security measure for unexpected events. Reserves for emergency situations ensure that the business will keep running smoothly during difficult circumstances.

15. Get involved in Strategic Negotiations

Set up favorable agreements with vendors and suppliers. The ability to negotiate discount or extended terms on purchases will contribute to an increase in cash flow. Negotiation skills play crucial roles in maximizing financial resources.

16. Regular Financial Health Check

Perform periodic checks on the financial health of the business to evaluate the overall financial health of the company. This includes reviewing the most important financial indicators as well as identifying areas of improvement and adapting strategies to keep pace with changing business goals.

17. Proactive Credit Management

If you are a business that offers credit to their customers, adopting an effective credit management strategy is essential. Check the terms of credit regularly evaluate creditworthiness, and modify credit limits to reduce the chance of late payments.

18. Continuous Learning and Continuous Learning and

The landscape of business is ever-changing and effective cash flow management requires constant learning and adapting. Keep up-to-date with changes in the economy, trends in the industry and regulatory changes so that you can make the necessary adjustments to your the financial strategies.

Implementing these strategies in managing your cash flow procedures can significantly aid in achieving financial stability. Proactively and regularly reviewing the flow through your bank account is essential to identifying problems and implementing strategies to ensure long-term successful outcomes.